Regional Competitiveness Analysis: Process and

Measurement

The emphasis on regional

competitiveness has gradually gained lately in strength and scope. From the

first EU Reports on competitiveness

which signalled worrying trends relative to the competitive advantages in both

global and local contexts to the present strategic guidelines of the Community which

makes the competitiveness of regions a priority theme, the topic has come to

hold the centre stage at the European policy-making level. The renewed Lisbon

Agenda requires that 'the Union

must mobilise all appropriate national and Community resources - including

cohesion policy' and makes clear that greater ownership of

the Lisbon

objectives is only possible trough involving regional and local actors and

social partners (Commission 2005).

The development sources are regionally

divided in a strong relation to the local abilities to put at good use certain

common determining factors of the entrepreneurial initiative. Various regional

developments are accounted for by an emerging entrepreneurship potential,

independently of certain geographical cliché or of any deterministic nature.

The emergence of new perspectives in

creating competitive advantages at national level clearly emphasizes the role

of local factors and economic initiative in the general economic development of

a country through conceptual constructions such as industrial clusters or

districts, innovation networks or competence centres. However, at the same time

there is a reduced offer of empirical analysis which examines the relation

between economic initiative and local economical development systematically

(OECD 2003: p. 10; p. 13).

The regional environment is shaped by three

important groups of influences on entrepreneurship, namely factors specific to

the macro-climate, micro-climate factors and factors specific to each person.

The enterprise macro-climate is characterized by indicators which reflect such

aspects as regional infrastructure, regional cultural level, economic

situation, or political systems. All these factors however receive different

interpretations and therefore the micro-climate factors of the entrepreneur's

'world' are represented by this infinite variety of ways of

perceiving the surrounding reality. Thus, the reactions, the vision, the

strategy, the action manner, the efficiency and of course the success are

mostly the result of micro-climate factors beneficial for the enterprise

initiative. Another category of factors specific to the entrepreneur includes

age, gender, social status, education level; these factors can describe the

intensity of the latent enterprise initiative or the evolution of the already

manifested one.

The theoretical background increasingly

combines the macro aspects of industrial policy with the regional ones of the

economics of agglomerations. The EU experts wonder in a report of the European

Commission (2002) if cluster policy is not a way of reaching the EU landmark

objective of becoming the most competitive region in the world at the horizon

of 2010. The same study offers details that are less common for standard

economic texts: the initiatives dedicated to generating new businesses were

equally divided between medium and big urban localities, and rural ones and small

towns (European Commission 2002: p. 21). This is prima facie evidence regarding the existence of some conditions for

the development related rather to the economy of the region than to some

inherently better influences, of historical, psychological or any other nature.

Beyond the

academic preoccupation, it can be distinguished a reorientation of the public

attention towards this kind of problems. For example, if the annual

competitiveness reports of the European Union (EU) focused at the beginning only

on the comparison between EU and its advanced peers, the last reports reveal a

need of extending the analysis regarding the implications of the competitive

policies to a national level.

This particularly means that regional competitiveness plays a new, enhanced

role through its emphasis on regions that enjoy the biggest increases of

competitiveness. At the same time, the regional level of analysis also crosses

the national borders by drawing attention to the way the productive capacities

are reallocated in the widened European area especially because of the increase

of the industrial production in those fields where important economies of scale

(internal or external) can be achieved.

This material proposes first a review of the theoretical aspects of

regional competitiveness in order to enlighten the factors and analytical

approaches usually deemed relevant to determine which factors of local

development affect success or lead to failure. The second section offers a

first glimpse on the entrepreneurial potential of the Romanian regions.

Finally, in the third section, several indicators of measurement are discussed for

their significance in producing reasoned policy recommendations.

I Process

Irrespective of definitions, competitiveness is normally linked to

such tangible outcomes as continued productivity growth, high real wages and

standards of living, and vibrant processes of innovation. Conditions that are

necessary for the study of national competitiveness are likely to be common to

regional-level analyses, although in this latter case the usual constraints -

membership of a currency union, factor mobility, barriers to trade, absorption

of macroeconomic shocks - are indefinitely relaxed. At the same time, the

reciprocal relationship should also be considered especially in connection to

the cooperative behaviour on the international level.

If a definition is nonetheless required, regional

competitiveness may be defined as the ability of a region and, therefore, of

its public authorities, to retain its local businesses and skills base and to

attract foreign investment (CSR and the SME). Its competitive characteristics

are accordingly based, albeit not exhaustively, on:

- Infrastructure quality

- The general quality of the environment

- The quality of the region's research and innovation

centres

- The ability to retain and attract skilled manpower

- Taxation

- Workforce cost and quality

The normal analytical framework uses concepts from

- neo-classical

economics, which points to physical and human capital as key influences

- new

growth theory, which emphasizes that the accumulation of knowledge could

generate increasing returns, where knowledge is measured as the skills of

the workforce, such as education levels or spending on education, or

through measures such as R&D expenditure

- cost analysis,

which mainly relates to unit labour costs

- localisation/specialisation

effects, which takes into account that geographical industrial

concentration is the equilibrium outcome of countervailing forces

(centripetal and centrifugal)

However, the economists are well aware that growth and

competitiveness more often than not are not part of a positive correlation

implying that more growth is equivalent to improved competitiveness. It is for

this reason that an analysis of the unfolding developments should be carefully

considered against the theoretical background. In this sense, the EU adds

valuable clarifications to the understanding of the objectives of any

competitiveness initiative: 'The aim of the new regional competitiveness

and employment objective is to anticipate and promote economic change by

improving the competitiveness and attractiveness of EU regions.' (Commission

2005: p. 90)

There is a clearly defined tendency (Commission 2003: p. 131) to

link the concept of regional competitiveness to those circumstances of economic

activities conducive to clustering in a limited number of places and within

clearly defined boundaries. Clusters

are generally associated with better economic performance:

l

Financial

services in London

or on Wall Street

l

Fashion in

Paris or Milan

l

Entertainment

in Hollywood

l

Chemicals

in Basel area

l

Movie

production in Buftea area

The insights from the new

economic geography offer the basics of the economics of agglomerations (clustering):

l

Agglomeration of economic

activities is dependent on the force of dispersion and the force of

concentration

l

At very high trade costs,

industries will be forced to

develop locally

l

At very

low costs, necessary inputs can be delivered to wherever the factor costs are

lowest

l

The

agglomerations reinforce the comparative attraction of regional economies

Observations of various instances of regional development reveal

that non-codified knowledge plays a salient role in laying the foundations of

any form of local/regional economy. This tacit form of knowledge is

'sticky' because it borrows from local patterns of development and

consequently it is best transmitted via face-to-face interaction. Geographical

proximity matters because social capital - the standard representation of tacit

knowledge as factor of production - uniquely configures a region in terms of its

intrinsic conditions for competitive upgrade.

The breadth of regional advantage is twofold:

- Traditional vs.

science based - Competitive success is characteristic across technological fields

- Local vs. global

- Examples of cross border

regional clusters include

-Glass cluster in Upper Austria (A), Bavaria (D)

and Bohemia (Czech Republic)

-Textile cluster in Lower Austria (A) and Bohemia (Czech Republic)

-Technical cluster in Styria (A) and Slovenia

-'Dommel-valley' on the Belgian-Dutch border consists of regional clusters

of high-tech firms and knowledge organisations

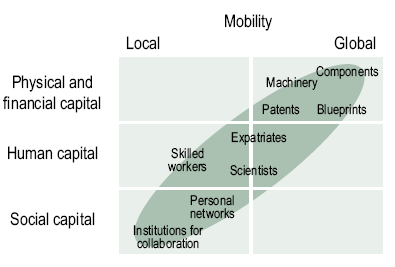

Figure 1. Capital and mobility

The Cluster - Standard definition and characteristics

Clusters are

geographic concentrations of interconnected companies, specialized suppliers,

service providers, firms in related industries, and associated institutions

(for example, universities, standards agencies, and trade associations) in particular

fields that compete but also cooperate. (Porter) From this definition results

that a typical representation of agglomerative economies is described

simultaneously by

l

Spatially

concentrated economic activities

l Critical mass of economic actors

l

Specialized

economic

actors

l Multiple actors, which addresses several a bundle of markets

l Competition and cooperation strategies involving the participants

l

Adaptation

over time among the various

actors that are interlinked through the cluster.

Regional competitive success is built on

such factors as:

l Clusters and Productivity

Access to Specialized Inputs and Employees

Access to Information

Complementarities

Access to Institutions and Public Goods

Incentives and Performance Measurement

l Clusters and Innovation

New buyer needs

New technological, operating, or delivery possibilities

Capacity

to act rapidly on these insights

l

Clusters

and New Business Formation

Barriers to entry

are lower than elsewhere

Better information about opportunities

Firms easily perceive gaps in products, services, or suppliers to fill

A lower risk premium on capital

A significant local market

Barriers to exit

can also be lower

l

Competition and cooperation within clusters

Vertical

relationships (those with buyers and suppliers)

Sharing

information that can contribute to new product and process developments or to

allow gains through better coordination of activities

Horizontal

relationships (those with direct competitors)

Tradeoff

between access to greater resources versus the potential for loss of

proprietary information or the creation of stronger competitors

Table 1. Activities that are

regarded as being of some importance or of importance for coordinating

activities among the firms in the clusters

|

R&D

|

Basic research

Applied research

|

|

Production

|

Production

Bundling of products and services from

several firms

|

|

Inputs

|

Joint purchase of raw materials, components

Joint purchase/carrying out of service

functions

|

|

Training

|

Management training

Other education or training

Technological survey

|

|

Marketing and sales

|

Market research

Joint branding

Joint selling activities

|

|

Logistics

|

Joint warehousing

Joint transportation

|

|

Government relations

|

Lobbying government

Coordinating public-private investments

|

Cluster analysis must

become part of competitive assessments, along with company and industry

analysis.

The appropriate

question for firms is not whether to compete or cooperate, but rather on what

dimensions to compete and on what dimensions to cooperate.

Private sector roles

in cluster upgrading can be found in all parts of the diamond.

Pitfalls

on the way to regional development

1) Sclerotic industrial agglomerations

l In the eighteenth century, Sheffield (United Kingdom)

was the world's leading supplier of cutlery. Sheffield

was known as the 'factory without walls' due to its concentration of

many small cutlery firms and suppliers.

In the late nineteenth century, Sheffield was overtaken by its long term

rival, Solingen, a similarly structured cluster

in Germany.

In the latter portion of the twentieth century, as Sheffield faded, a new

challenger emerged for Solingen.

Seki (Japan),

which has been called the 'Japanese Solingen,' is yet another cluster

of small and medium sized firms.

In the early 1990s, there were approximately 300 cutlery firms in Solingen and 600 cutlery firms in Germany have

been neck and neck as the world's leading exporters of cutlery since the 1970s.

2) The low end of high tech - the technological

threshold

Table 2. Examples of regional clusters (S= Science based; T= Traditional)

|

Country

|

Cluster name

|

|

Finland

|

Technology

Cluster in Oulu (S); Shipbuilding in Turku (T)

|

|

Germany

|

Chemical

Industry, Northern Ruhr area (S);

Enterprise-information-system, Lower Saxony (S); Media Cluster; North

Rhine-Westphalia (T)

|

|

Greece

|

Industrial

District of Volos

(sundry metal products and foodstuffs) (T); Industrial District of Herakleion

(foodstuffs, non-metallic minerals) (T)

|

|

Ireland

|

The

Dublin Software Cluster (S); The Dairy processing Industry (T)

|

|

Italy

|

Biomedical

cluster in Emilia-Romagna (S)¸ Eye-glass cluster in Belluno County (T)

|

|

Spain

|

The

Cluster of Machine-Tools in the Basque Country (S); Shoe Manufacturing in the

Vinapoló Valley (T)

|

|

United Kingdom

|

Cambridgeshire

(High-tech) (S); British Motor Sport Industry, Oxfordshire/ Northamptonshire

(T)

|

Source:

European Commission, 2002

Policy

initiatives

Analytical framework (Hoover and Giarratani):

1. Causes of growth. Why do some regions grow faster

than others? What are the primary initiating factors responsible, and through

what processes do these causes operate? What is the role of interregional

trade, migration, and investment in the spread of development from one region

to another?

2. Structure. How does regional economic structure

relate to growth? What kinds of structure are conducive to growth, or the

reverse? What structural changes are associated with growth?

3. Convergence. Why is convergence so much in

evidence? Is it universal and inevitable, or is it subject to reversals?

4. Control over regional development. Can

regional development be substantially guided by policy? If so, what are

defensible objectives and appropriate policies?

On overview of the European policy initiatives is provided by Table A1

in Annex.

Specific initiatives:

Taking account of specific

geographic situations

Certain territories experience

Competitiveness handicaps that are

hard to overcome

General initiatives:

Developing regional innovation structures, based on region-specific

priorities, needs, circumstances and preferences that vary depending on the

period of time and the region in question

Stakeholders industry

and trade, universities, technical universities, research institutes

Policy actions: industry-specific

education and training programmes, to familiarise people in the use of new work

methods and tools; to ensure the availability of competent workforce while

considering the regions' changing economic structures, the provision of

entrepreneurship training, from primary school to university, to promote the

development of services and markets that support entrepreneurship, to adapt

technologies and procedures that can change existing production structures and

enhance overall productivity.

II Entrepreneurial potential of the Romanian regions

This section attempts to glance through the

workings of the real economy with the help of some empirical evidence on the

Romanian economy. Against that background, a methodology to link development to

entrepreneurship is proposed and subsequently discussed. Given the limitations,

the dataset has been selected with respect to the longest possible list of

economic and social-cultural aspects which by and large correspond to the

macro- and micro-climate of influences on entrepreneurship. A set of thirty-three

indicators

has been processed for all 42 regional administrative counties / units with the

help of the statistical software SPSS, using the cluster method. This cluster

method is based on a specific algorithm for an optimum grouping of the counties

depending on the similarities and differences between the selected indicators.

The programme groups similar counties based on the selected indicators while

the particular cases presenting specific properties much different from the

other cases, appear separately.

The 'cluster' number or the

number of similar areas (counties) has been set to eight. This option is

sustained by the argument that there are as many development regions, and by

analogy there can be observed how the counties fare in this statistical

investigation as opposed to their administrative location. On the other hand,

other types of divisions which were experimented, for example in groups of 2,

4, or 6, frequently led to many groups represented by only one county that made

the analysis highly irrelevant.

The conclusions include observations on

various iterations depending on different combinations of the chosen

indicators, but a special significance has been given to the combination that

gets together the whole set. Particular references are made only to this latter

case. The results are given in Table A2

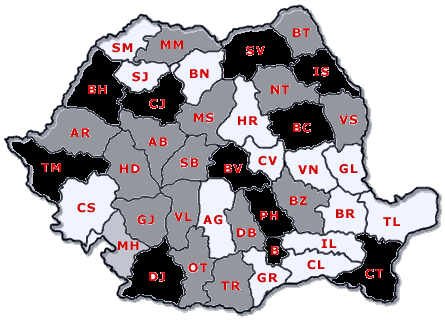

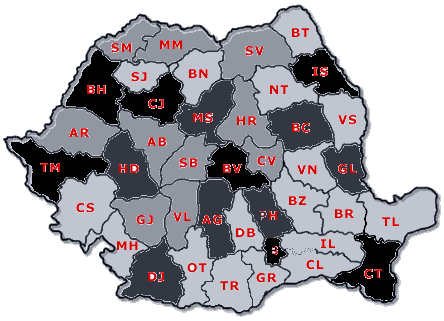

and Figures A1 and A2 in the appendix. The findings

attempt to reveal local areas of development (counties) with a developed

entrepreneurial spirit, those that possess such potential and those with a poor

situation and contrast these more nuanced results with the familiar image of,

say, discrepancies between the advanced West and the poor East.

There should be first noted that the

processed data reveal several 'isolated' countries/areas-Bucuresti,

Arges, Constanta,

Mehedinti-which for some reason singularize themselves. As expected, Bucuresti

comes highly on top with extremely positive levels on all indicators, with the

exception of the criminality rate, in comparison to the rest of the country. As

for the other groups, they usually expose a particular combination of

favourable and less favourable characteristics that require interpretations

from case to case. For example, Constanta

appears to have a somewhat established entrepreneurial environment, but what

sets it apart is a very low level of development in the research area. Due to

an exceptionally high level of activity in two service sectors-tourism and

transportation-that do not require big product development expenditures, the overall

score may still rank this county in the top league. However, in order to

improve the accuracy of assessments in such cases, Table A2 enlists what are the common characteristics of each

cluster and Figure A2 is added to

illustrate a narrow representation of development which is based on a selected

set of indicators of mainly economic nature.

More interestingly, the forming of a

cluster of counties with very good performance levels-Brasov, Timis,

Cluj, Iasi, Bihor, Bacau, Galati, Prahova, Mures, Dolj (Table

A2, second row)-is suggestive of a remarkably even distribution of

entrepreneurial activity throughout the country. According to the logic of this

methodology, these counties show the highest level of the enterprise

development. Two observations arise in this context. First, this group features

a sub-cluster consisting of Brasov,

Timis, Bihor, Cluj, and Iasi

that preserves its particularities over repeated iterations. On the basis of

previous commentaries, adding to the large group Bucuresti, Arges and Constanta will make up for a more faithful illustration of

the first tier of entrepreneurial development in Romania. Second, it should be also

noted that several counties in this group disproportionately take advantage of

the presence of either a large company (e.g. Dolj-Daewoo Automobile, Galati-Mittal

Steel, Arges-Renault), or

industry (Prahova-crude oil). It is under these circumstances that the limits

of the statistical investigation become mostly visible.

There are still other several counties with

a manifest good potential for enterprise development, but in their case

adequate support programmes are needed. For counties like Arad,

Sibiu, Alba, Satu-Mare, Maramures, Valcea, Gorj,

Covasna, Harghita, and Suceava an encouraging environment for economic

initiative develops amidst slight 'sparkles' in certain fields and

small disequilibrium in others. Rest of the counties finds below or much below

average for most of the relevant indicators. In these cases, complex projects

will be necessary in order to bring them to acceptable levels of development. A

list of the worst performers-Ialomita, Caras-Severin, Giurgiu,

Vrancea, Calarasi, Dambovita, Vaslui, Botosani-makes

clear that at least as far as the bottom rank is concerned there is distinct

localization of problematic issues that follow the South - South-East - East

alignment.

A notable implication of the analysis

consists in the strength of the interdependence between the economic factors

and the social-cultural ones within a region. Generally, it may be noticed that

counties with a good economic milieu also present a favourable social-cultural

situation; the relation goes the other way around too.

These estimates reache results that are

similar to conclusions of reports touching on the same topic (e.g. UNDP 2004).

It nevertheless advances the discussion by finding similarities over a mixed

set of influences on entrepreneurship across Romanian regions. The conclusions

come in two areas of interest.

Firstly, the results underpin a view on

enterprise dynamics that may be reasonably divided in three areas of development.

There is first a group that shows a favourable climate for enterprise

initiatives, from business performance to market networks and supporting social

infrastructure. There are then counties satisfactorily positioned to outgrow

their present medium-level enterprise development level. They certainly have

strong advantages that must be further pursued, but at the same time favourable

conditions must be created for the diversification of the regional enterprise

initiatives. Through inadequate policies, these areas with potential can be

forced towards involution as well, and it is precisely for this reason that

this case requires special attention. Finally, the remaining counties expose

such a large range of unsuccessful achievements that makes them unattractive

for business development.

Secondly, it is somehow part of the

intellectual tradition the fact that regional development should be understood

in terms of different business habits, favouring 'mentalities', in

general, inherently better conditions in certain regions as opposed to others.

This investigation acknowledges indeed different practices with regard to

regional business initiatives, but the abilities for the establishment of some

thriving economic activities find a favourable environment for manifestation in

any region. The variety of local conditions and capabilities forms a particular

development fabric which should be put to good use through public policies and

business strategies.

III Measurement

This section deals with how to measure

regional competitiveness and its main determinants. Although there is no

universally accepted definition of regional competitiveness, this concept is

intended to measure the level of economic success displayed by regions. This is

usually done by constructing a set of indicators and then comparing them,

across regions, in order to quantify the level of success each region has

achieved. The usefulness of this exercise is to see whether the factors

underlying success can be applied elsewhere, notably in regions that perform

more poorly.

Although both theoretical and empirical

work have generated a series of indexes that assess a region's competitiveness,

a few issues need to be addressed first, namely:

What are the determinants for regional development?

Which indicators are most appropiate to describe the level of

regional development?

What do these indicators imply for the direction of causation

To what extent data availability allows regional analyses in

comparable terms.

As a general rule, competitiveness is

determnined by productivity, defined as a the output value per units of input,

with which a region employs its human, capital and natural resources. In turn,

productivity sets a region's standard of living as reflected by wage level,

returns on capital and human resources. In fact the link between productivity

and 'per capita' GDP is quite strong. This can be seen by breaking down the

'per capita' GDP indicator into a series of component factors:

(Productivity) *

(Work-Leisure choice) * (Employment Rate) * (Demographic Factor)

Thus, one of the most common regional

indicator used in practice to measure a region's economic success is the GDP

per capita. In the expression above productivity is defined as GDP/hours

worked. In contrast to the other way of measuring productivity, GDP/employee,

the GDP/hours worked indicator has the advantage of measuring more accurate the

labour effort, an important consideration when particular sector activities

require different profiles of work intensity.

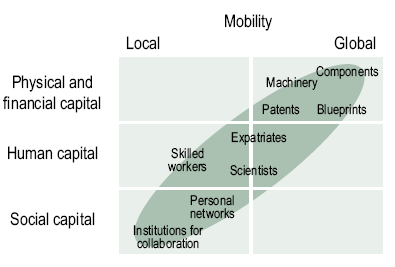

A variety of general factors affecting

competitiveness are suggested by the literature (see Figure 1.3). For instance,

neoclassical theory stresses out the importance of physical and human capital

assuming that technological influences are exogenous. To remedy the ad hoc

assumption of exogenous technological influences, the growth theory endogenised

technology within the system, suggesting that the accumulation of knowledge

could generate increasing returns - as brought about, for instance, by human

capital accumulation.

Another stream of economic theory has

attempted to explain regional competitiveness using the geographical

concentration approach.

Figure 2. Regional Competitiveness Theories

The Neoclassical View

Initial Conditions

Level of Investment

Human Capital

Technology Driven

|

Growth Theory

Endogenous Technological

Advance

Externalities

|

Regional

Competitiveness

GDP/Employee

GDP/Hours Worked

|

Economic Geography / Trade Theory

Agglomeration Effects

Urbanisation

Transport Costs

Economies of Scale

Sectoral Specialisation

|

Knowledge-Based Factors

- input measures (human

capital, R&D infrastructure, investment in R&D, number of

researchers)

-

output measures (patents, process and product innovation)

|

Cost Competitiveness

Unit Labour Cost

Price of public input

Ratio of prices tradeable/nontradeable

|

Source: Adapted from the European Competitiveness Report, 2003.

Cost competitiveness is another way through

which regional competitiveness can be assessed. Economic theories that focus on

cost are Ricardo's comparative advantage or Heckesher-Ohlin's trade thory. The

unit labour costs (ULC) is a more direct way of measuring how expensive is

production in a given region. ULC is defined as the ratio of labour costs per

unit of output. Here, the former includes both the gross wage as well as

indirect costs per employee. Thus, higher ULC implies a loss of

competitiveness. This rises when the increase in labour costs is higher than

productivity increases.

Obviously, different theories would require

the usage of different indicators. However, in practice, a number of indicators

could have similar informational content. Therefore the challenge is to select

the most relevant indicators that would hold the highest explanatory power in

assessing a region's competitiveness. The most common used indicators are

listed below:

Gross Value Added (GVA). It

gives an indication of the value of economic activity in the region. It usually

allocates the incomes received by employees to where they work. Often, the

GVA/head figure is reported.

Gross Disposable Household

Income. It measures the income received by households and implicitly, living

standards.

Labour Productivity. This is

computed as GVA/workforce job and could be assessed within different sectors of

the regional economy ie industry, services, etc.

Investment by domestic and

foreign firms. It expresses the potential future output growth of the region as

it represents addition to the region's capital stock. A common proxy for

investment is the net capital expenditure made by firms.

The Value of Exports. This is

dependendent of the size of the regional economy. In the long run it is solely

the increase in export value that ensures the expansion of the regional

economy.

Average Earnings. This

indicator measures the marginal product of labour and it is usually expressed

as hourly earnings. Often it distinguishes gender pay, overtime and full time

pay.

Employment and Unemployment

Rates. These quantify the region's workforce participation rate.

Business Registration and

Survival Rates. One indicator of business formation is the number of new VAT

registrations each year as a percentage of firms registered for VAT at the end

of that year. The survival rate reflects the number of firms - as given by the

VAT registrations - still in business after a certain number of years.

Entrepreneurship. The indicator

aims at measuring the contribution made by entrepreneurs to the regional

economy.

Knowledge could be measured as the skills of the workforce, such as

education levels or spending on education, or through measures such as R&D

expenditure. The latter can, in

principle be computed for three sectors - government, business, and

higher education establishments - although in practice data availability

constraints makes the choice of total R&D expenditure preferable in orderer

to ensure reasonable coverage across space and time.

Innovation can be proxied by the R&D expenditure, expressed as

above. Another way to measure innovation is by the percentage of firms that

report co-operation agreements on innovation activities.

The stock of human capital can be proxied by the working

population - by age structure if

necessary - personnel employed in R&D, employment in high-tech sectors,

total number of students and those involved in tertiary education.

Transport Infrastructure. This indicator could have many

subcomponents but the relevant ones are the mode of transport to work and the

average speed on roads.

Industrial property and office rental costs.

There are other factors - as suggested by theory - which can have an

effect on competitiveness but for which there is no quantifiable approximation.

For instance, much of government policy falls under this category, as do

indicators measuring the extent of venture capital activity, business

registration rates, and the presence of high-tech clusters. However, such

features can be examined to see whether they are present in the characteristics

of those regions which display them. In addition other factors such as the sectoral structure, investment or the degree

of spillover effects are important when assessing a region's competitveness.

Empirically, the most prosperous regions have high share in market

services, usually, over 70%, but success tend to depend on the type of market

service which dominates. For instance, tourism services are not associated with

particularly high productivity levels. Investment measures the change in

capital stock of a region's economy and is an important indicator of future

output performance.

While indicators are useful in assessing a region competitiveness,

most of the times these are computed in isolation. Creating a composite index

at the local or regional level - that would comprise information contained in a

number of different single indicators - would be a step forward. To date, there

a number of organisations that compute such indices, a review of which is

presented below:

The World Economic Forum (WEF) Index - Global Competitiveness Report

1999. This is one of the most complex attempts to date to construct a composite

competitiveness index. It has been devised with inputs from Porter (1999). The

index is based on quantitative and qulitativ data classified into eight groups

with a weight of 75% for the former. Furthermore, the WEF Index assigns the

following weights to each of the eight groups classification indices as

follows: openess, finance, government and labour 1/6 each, infrastructure and

technology 1/9 each, management and institutions 1/18 each. The weights are

chosen through regression analysis looking at the correlation coefficient with

the per capita economic growth.

The 3-factor model (Huggins, 2003) is a composite index which

incorporates data available at local, regional and national level. The index is

based on three components, inputs, output and outcomes. The variables used to

construct the composite index - and their associated weights in brackets - are:

a)

business density measured as

the number of firms per capita (0.111).

This is a measure of the potential future development of new firms.

b)

proportion of knowledge-based

businesses measured as the share of knowledge-businesses in total businesses

(0.111).

c)

GDP per capita, measures the

historical impact of competitiveness (0.333)

d)

average earnings, with high

earnings being usually an indicator of high competitiveness (0.166)

e)

economic activity rates which

is a measure of how human capital is employed in a region (0.111)

f)

unemployment (0.166)

Huggins (1999) calculates such a UK Competitiveness Index for all

regions of the UK

allowing for different weighting systems that could influence the scores and

rankings of the index. The author's result are somewhat encouraging in what

different weighting systems does not change significantly the rankings of the

index.

United Nations Industrial Development Organisation (UNIDO). UNIDO

produces a scorecard which is comprised of two rankings:

1) A competitive industrial performance index on the basis of four factors and

2) A ranking of economies by the five drivers of industrial performance,

namely: knowledge, inward openness, financial system, governance and the

political system. All these five factors are obtained through multivariate

analysis

from an intial set of 29 relevant indicators. Out of the five indicators,

knowledge is by far the most important one and comprises of variables which are

highly correlated with the creation, diffusion and use of knowledge such as

R&D and innovation or quality mangement and education. The inward openess

has indicators pertaining to import trade and inward FDI. The financial system

indicator refers to aspects such as market capitalisation, country risk and

access to credit.

The Development Report Card produced by the Corporation for

Enterprise Development, which generates three indices:

a)

Performance Index which measures the following: employment,

earnings and job quality, equity (with respect to income), quality of life,

resource efficiency and a number of trend indicators which measure changes in a

set of variables.

b)

Business Vitality Index which

comprises of indicators reflecting cometitiveness of existing businesses, entreprenurial

energy, and trend indicators

c)

Development Capacity Index

which includes information relating to human, fiancial and infrastracture

resources, innovation assets, amenity resources and trend indicators.

The grades are computed as follows:

Raw data are collected for all

the 68 measures contained in the indicators above.

Each state is individually

ranked from 1 (best) to 50 (worst) in every measure based upon the raw data

obtained.

To calculate both the index and

subindex scores, the relevant measure rankings for each state are added

together. Again, the scores are ranked from 1 to 50.

States that rank from 1-10 earn

'A's, those ranking from 11-20 earn 'B's, states that rank from 21-35 earn

'C's, those that rank from 36-45 earn 'D's and states ranking from 46-50 earn

'F's.

When a tie occurs, each state

receives the same rank and the next best performing state is ranked as if the

tie had not occurred. For example, if two states have the best score, each

receives a '1' ranking and the next state is ranked '3'.

References

Bergman, Edward M. and

Edward J. Feser, Industrial and Regional

Clusters: Concepts and Comparative Applications, West

Virginia University's Regional Research Institute, Electronic version, [https://www.rri.wvu.edu/WebBook/Bergman-Feser/contents.htm][26.10.2006]

Commission of the European Communities, 'Cohesion Policy in Support of Growth and

Jobs: Community Strategic Guidelines, 2007-2013', Com (2005) 0299, Brussels, 05.07.2005

Commission of the European Communities,

'European Competitiveness Report 2003', Commission Staff Working

Document, SEC(2003)1299, Brussels,

12.11.2003

Commission of the European Communities, 'Final Report of the Expert Group on Enterprise Clusters and Networks', Enterprise Directorate-General, Bruxelles,

2002

Commission of the European Communities, 'Regional Clusters in Europe.'

Observatory of European SMES (3), 2002

''CSR in the SME and Regional

Competitiveness' Working Group : Introduction'

[https://ec.europa.eu/enterprise/csr/documents/mainstreaming/ms_sme_topic1_discussion_en.pdf]

[26.10.2006]

Department of Trade and Industry (DTI), Regional Competitiveness & State of the Regions, URN 06/259, July 2006.

Hoover, Edgar M. and Frank Giarratani, An Introduction to Regional Economics, 3rd

Edition, West Virginia University's

Regional Research Institute, Electronic version, 1999

[https://www.rri.wvu.edu/WebBook/Giarratani/hoover.htm] [Oct. 2006]

Huggins, Robert, Creating a UK

Competitiveness Index: Regional and Local Benchmarking, Regional Studies, Vol. 37.1, pp.

89-96, 2003

OECD, Entrepreneurship

and Local Economic Development, Paris, 2003.

'Towards a New Regional Policy in

2007', Report adopted by the CPMR Political Bureau, Kastoria (Greece), 21 January

2000 [https://ec.europa.eu/regional_policy/debate/document/futur/organ/crpm_kastoria_jan00_en.pdf]

[26.10.2006]

United Nations

Development Programme (UNDP) (2004), 2003-2004 National Human Development Report.

Romania,

[https://www.undp.ro/publications/pdf/NHDR2005eng.pdf]

[20 February 2006]

United Nations Industrial Development Organisation (UNIDO). Capability

building for catching-up. Historical,

empirical and policy dimensions, Industrial Development Report 2005

West Finland Alliance (WFA), 'European

Union's Regional and Structural Policies after 2006 Regional Points of

View', 24.4.2003